Navigating the Future: Smart Commercial Real Estate Investments Amid Economic Shifts

Today we're going a little more in depth into a subject we addressed earlier in the week: inflation and your commercial real estate investments. We'll talk some more about the how's and why's of inflation itself, how it can effect your CRE holdings, and how you can avoid losses and take advantage of opportunities in this type of climate.

The Economic Landscape and Commercial Real Estate Investments:

A Closer Look

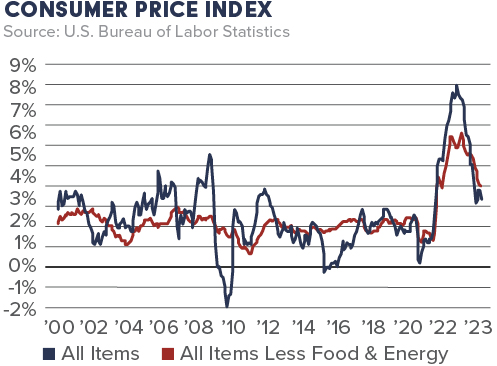

As we traverse the dynamic economic environment of 2024, the journey reveals both challenges and opportunities within the commercial real estate (CRE) sector. Recent reports underscore the resilience of the economy, albeit with caution from the Federal Reserve amidst fluctuating inflation rates. Notably, the core inflation rate, a critical indicator, reflects a significant shift from last year, hinting at a complex interplay between various economic sectors and commercial real estate investments.

Understanding Yield Spreads: Why CRE Still Holds Appeal

The comparison of CRE yields against corporate bond yields offers fascinating insights. Despite the tightness in yield spreads, there's an underlying potential for CRE investments to maintain, if not enhance, their appeal. This scenario presents a nuanced perspective for investors, suggesting that CRE could still emerge as a comparatively attractive option amidst financial market adjustments.

The Role of CMBS and Market Dynamics

The Commercial Mortgage-Backed Securities (CMBS) market indicates a potential pivot, influenced by the Federal Reserve's stance and treasury stabilizations. This shift could incentivize a reevaluation of CMBS execution strategies, highlighting the evolving dynamics within the CRE financing landscape.

Market Equilibrium and Capital Flows: Reading the Signs

Recent trends suggest a promising alignment between public and private cap rates, pointing towards a market nearing equilibrium. Moreover, a consistent increase in institutional allocations to private CRE emphasizes the sector's enduring appeal to a diverse range of investors.

Investment Strategies in the Current Economic Context

In navigating the commercial real estate investment landscape, several key themes emerge. The anticipation of a Fed pivot, buy-side optimism, and sell-side considerations play pivotal roles in shaping investment strategies. Additionally, the disconnection between CRE performance and the broader economy signals unique investment opportunities, particularly in light of the upcoming wave of loan maturities.

Investing in CRE: A Path Forward

Amidst the complexities of the current economic and investment climate, the potential for commercial real estate remains significant. Understanding the nuances of yield spreads, market dynamics, and capital flow trends is essential for crafting informed investment strategies.

Shelter Inflation

Understanding the Impact of Rising Housing Costs on Our Economy

Ever noticed how the cost of renting or buying a home has skyrocketed since 2020? This isn't just about finding a place to live; it affects our entire economy in a big way. Here's a simpler look at what's been happening and what might change soon.

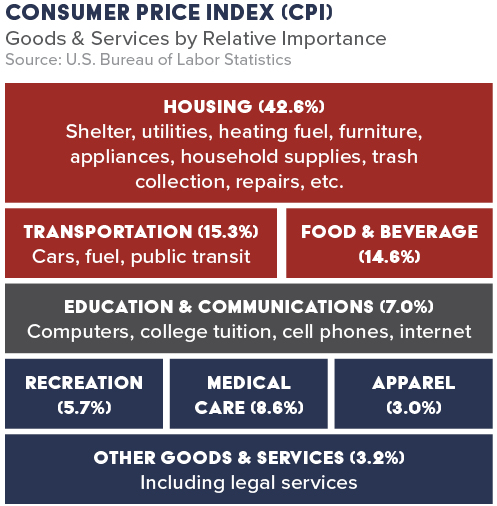

The Ripple Effect of Housing Costs

When the prices for homes and rentals go up, it does more than just empty our wallets faster. It actually makes a big wave through the economy, influencing everything from how much we pay for goods to the health of the housing market itself. A big part of this is because housing costs make up a large chunk of what economists call the Consumer Price Index (CPI), which is a fancy way of saying "how much the average basket of goods costs over time."

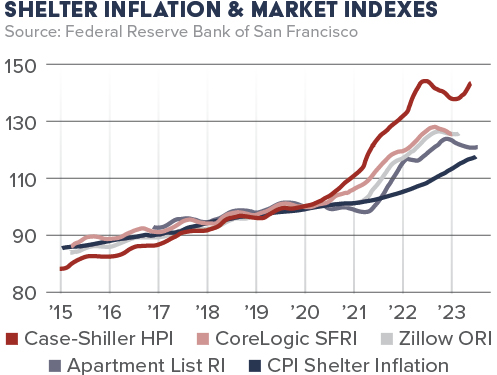

Since the pandemic hit, the cost to rent or own a home has jumped significantly. This has been great for property owners because their properties are worth more, but it's also pushed up inflation, leading to higher interest rates. These higher rates have made mortgages more expensive, slowing down the once-booming housing market.

What's Next for Housing Costs?

Experts are seeing light at the end of the tunnel. Some predict that the increase in housing costs might not only stop but could actually reverse. This means that by mid-2024, we might see these costs go down, making housing more affordable and easing inflation. This change could help stabilize the economy and make it easier for people to buy homes or invest in properties.

Why This Matters for You

This isn't just important for economists or real estate pros. It affects all of us. Lower housing costs mean more affordable living options and a healthier economy. It also means that investing in real estate could become more attractive again, with lower interest rates making loans more manageable.

So, while the past few years have been a rollercoaster for housing costs and the economy, there's hope that things might start to improve soon. This could be great news for everyone, whether you're looking to buy a home, rent more affordably, or looking at commercial real estate investments.

Seeking Expert Guidance in Commercial Real Estate Investments

Investing in commercial real estate offers a pathway to diversification and potential returns, yet it comes with its inherent risks. As we navigate these uncertain times, the value of expert advice cannot be overstated. For those considering commercial real estate investments, seeking the guidance of a Certified Commercial Investment Member (CCIM) like myself can provide the insights and expertise necessary to make informed decisions. For a tailored investment strategy that aligns with your goals and the current economic context, don't hesitate to reach out.

Brion Costa, CCIM

Century 21, Commercial

626-695-7385

DRE#: 00939864