Inflation and the Commercial Investor - Riding Out The Storm

In today's economic landscape, commercial real estate investors face the dual challenges of inflation and rising interest rates. As a Certified Commercial Investment Member (CCIM), I understand the intricacies of navigating the trying conditions created by inflation and the commercial investor. This post explores strategies for weathering inflation, enriched with government-sourced graphs for a comprehensive analysis.

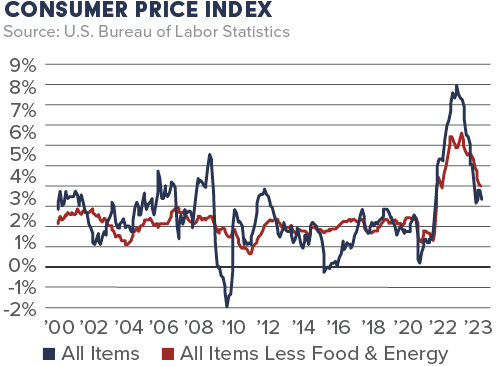

This graph illustrates the recent trends in the Consumer Price Index (CPI), highlighting the inflationary pressures in the economy.

Understanding Inflation's Impact on Commercial Real Estate

Inflation plays a significant role in shaping the commercial real estate market. By examining the Federal Reserve's actions through rate hikes, we gain insights into the broader economic implications for property values and investment strategies.

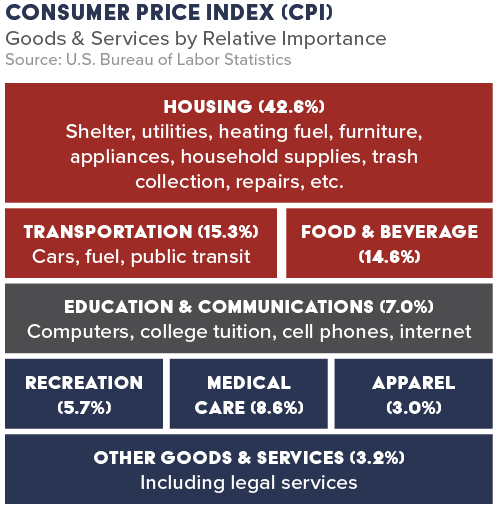

Core Inflation Metrics and Their Significance

The Consumer Price Index (CPI) and Core CPI are crucial for understanding inflation's nuances. Core CPI, in particular, offers a stable view by excluding volatile items like food and energy, providing a clearer insight into inflationary trends.

Displaying the steady rise in Core CPI, this graph underscores the importance of monitoring underlying inflation trends for informed investment decisions.

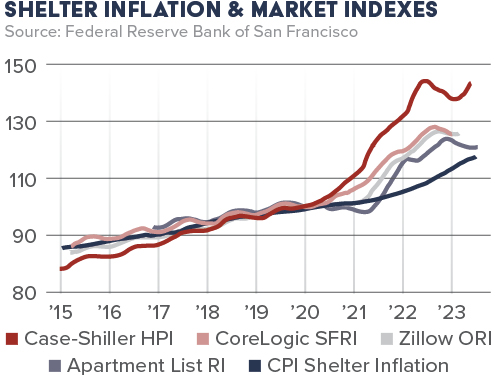

This graph depicts the inflation rate for shelter costs, crucial for understanding the direct impact on commercial real estate investments.

The Impact of Shelter Costs

Shelter costs significantly influence CPI and, by extension, the real estate market. The dynamics of shelter inflation are pivotal for commercial investors aiming to anticipate market movements accurately.

Strategies for Mitigating Inflation Risks

Adjusting lease agreements, conducting thorough market analysis, and diversified investing are among the strategies to mitigate inflation risks. Leveraging insights from Core CPI data aids in robust financial planning and decision-making.

Navigating inflation as a commercial real estate investor demands a strategic, informed approach. Through the insights provided by the included graphs and our analysis, investors can better position themselves to thrive. Remember, while investments carry inherent risks, the guidance of an expert can be invaluable. I am here to assist with your commercial real estate investment needs, offering tailored advice to navigate these challenging economic times.

Brion Costa, CCIM

Century 21, Commercial

626-695-7385

DRE#: 00939864