Mortgage Rates - "Mortgage rates held steady this week at 3.65 percent for a 30-year, fixed-rate loan. It’s the first time all year that rates didn’t fall ..."

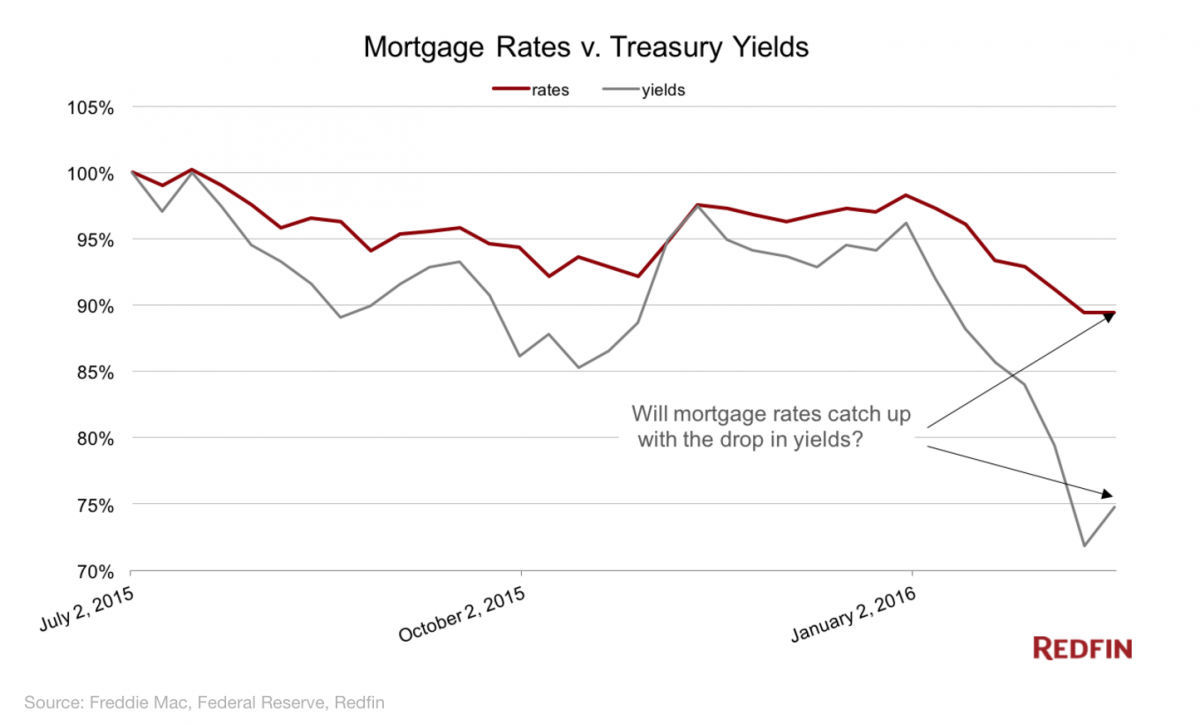

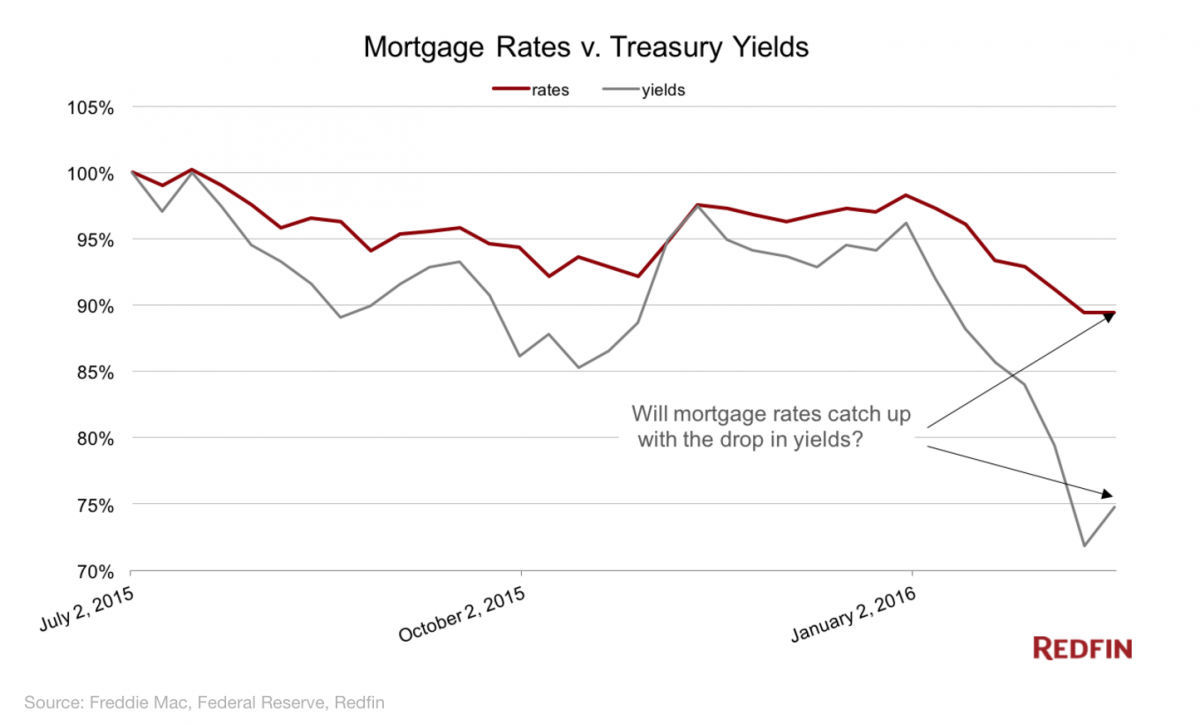

Do Treasury Yields Indicate Still Lower Rates Ahead?

Home Loan Rates Usually Follow Treasury Bond Yields Will This Hold True Again?

We've been predicting in these pages that you could pretty much rely on continued home loan prices in the "relatively low" range for the near future. Here comes an indicator that confirms that predicition, but also says we may see even lower mortgage rates here in the near future. If you've been sitting on the sidelines waiting for the "perfect moment" (not a good strategy to try to pick the bottom or top of any market, by the way), then you may just see it here over the next coupld of weeks. Treasury Bond Yields are usually a good indicator of where the mortgage market is going. Home loan rates seem to follow the Treasury yields pretty closely. As you can see in the chart above, Treasury yields have fallen signifigantly since the beginning of the year. Home loan rates have too, but they've not kept pace with the bond yields. This is a good indicator that we may see even lower home mortgage loan prices ahead in the near future as the two markets attempt to come back to a more normal balance. Here's an article by Lorraine Woellert. Lorraine is an analyst with Redfin and a contributor to Forbes, where this article appeared.Mortgage Rates: Will They Follow Treasuries Even Lower? | Forbes

ForbesSo what about mortgages? Look at how quickly Treasury yields are falling compared to mortgage rates. The yield on the 10-year Treasury has dropped 54 basis points since the beginning of this year. Mortgage rates have fallen only 36 basis points, according to Freddie Mac.Read More Here: http://www.forbes.com/sites/redfin/2016/02/18/mortgage-rates-will-they-follow-treasuries-even-lower/