Altadena post-fire investor activity:

Redevelopment or a vulture-feeding frenzy?

By Brion Costa, CCIM – Century 21 Adams & Barnes – Monrovia, CA

When the flames swept through the foothills of the San Gabriel Mountains,

especially in the Altadena area, the physical impact was visible: charred lots,

destroyed homes, displaced families. What has become less visible—but arguably

even more consequential—is what has followed behind the smoke: the surge of new

buyers, the transformation of neighborhood character, and the fundamental shift

in who owns land and who lives there. This article explores the Altadena

post-fire investor activity from multiple angles: who is buying, what is

happening to original homeowners, and what that means for rebuilding, renting,

and the future character of Altadena.

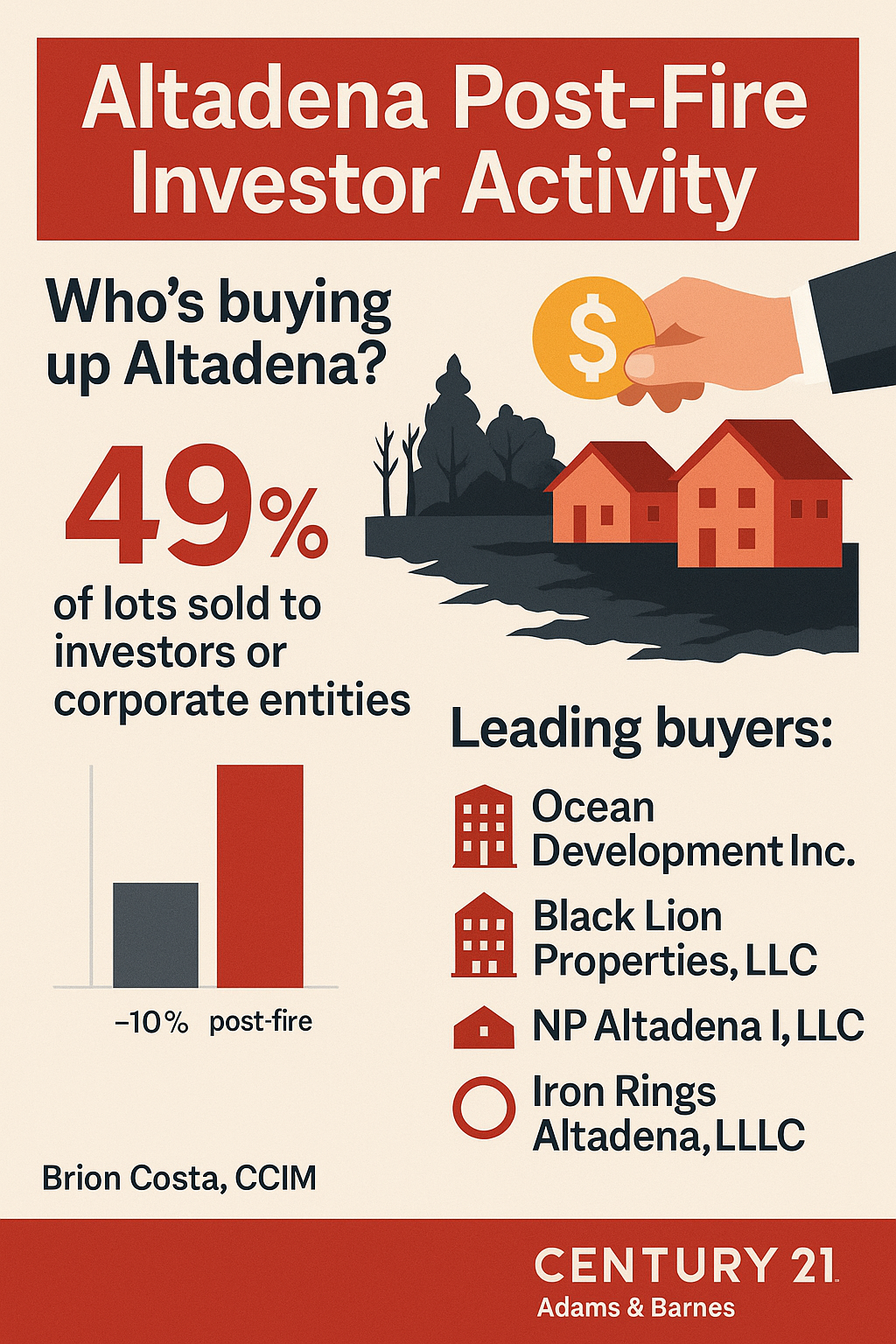

Who’s buying up Altadena?

One of the first questions in any conversation about post-fire land

markets is: “Who’s actually buying the lots?” In Altadena’s fire-scar zones the

answer is clear: a growing share of purchases are going not to original

homeowners rebuilding, but to investors, developers, and corporate entities.

Recent data show that of the approximately 151 lot sales in Altadena

between February 11 and July 5, 2025, nearly 49% were to corporate or

investor entities—an enormous rise compared with the ~10% baseline in the same

period a year earlier. This share climbs further when you broaden the time

horizon: by late September, among ~241 lots sold, over 56% went to

corporate entities.

The leading buyers include:

- Ocean Development Inc.: at least

16 lots in Altadena, a large LA?area builder stepping into the fire-lot

market.

- Black Lion Properties, LLC (Jesse

& Edwin Castro): “more than a dozen” lots, with aggregate reported

spend around $9-10 million.

- NP Altadena I, LLC (an affiliate

of New Pointe Communities): approx 13 lots, rebuilding targeted for sale.

- Iron Rings Altadena, LLC (linked

to private equity firm Virtua Capital): ~3-4 lots.

- Several other investment-LLCs

(e.g., Bloom Capital Investments and Sheng Feng Global Inc.) rounding out

the list of repeat buyers.

What these data reveal is a clear pattern: for the Altadena post-fire

investor activity, the typical buyer profile is a well-capitalized

corporation, LLC or developer—often coming from outside the immediate

community—and less frequently the original homeowner stepping in to rebuild.

Why aren’t more original owners

rebuilding?

To fully understand the implications of the investor surge, we must ask:

what happened to the original homeowner population? Why aren’t they taking back

their lots and rebuilding their homes instead of selling them?

From my vantage as a CCIM and longstanding practitioner in the Los

Angeles and foothill market, I see several structural headwinds:

1. Insurance and borrowing constraints

Many of the homes impacted in Altadena were owned by families who bought

decades ago—some back in the 1940s or 1950s—and built equity over generations.

But they often carried no or minimal fire insurance, or only limited homeowner

coverage. After the wildfire, these homeowners had little to no insurance

payout or uncertain future claims, leaving them with high out-of-pocket rebuild

costs. At the same time, in today’s environment, interest rates are elevated,

making reconstruction debt more expensive. When the math doesn’t add up, the

homeowner is forced to consider “sell the lot” vs. “borrow huge sums and

rebuild.”

2. Permitting and rebuild delays

Rebuilding in a fire scar zone isn’t as simple as “clear the lot, rebuild.”

Process delays—environmental reviews, grading, erosion control, increased

permit fees, special FireSafe requirements—mean that original homeowners face

years of uncertainty. Many lack the time, cash flow or patience to hold through

that process.

In fact, one UCLA LPPI brief found that around 70% of severely damaged

homes in Altadena showed no observable rebuilding or permit filing by

late summer, despite being months out from the fire. That suggests a strong

diversion of supply away from owner-rebuilding into the “sale to investor”

channel.

3. Generational inequities & displacement risk

Many of the original homeowners are low- and moderate-income families. Their

homes appreciated enormously in value. They may have been “paid off” or

low-mortgage, but they lacked access to the capital or risk tolerance to

rebuild in place. The option to rent back into the newly built homes is often

simply out of reach: new rental stock is commanding $2,500–$4,000+ per month in

Altadena, a steep barrier for the original owner-household.

This creates a kind of displacement: the family who held the home for decades

now sees their property sold by an investor, their rebuild option gone, and

their chance for returning diminished.

The business model: build, rent or flip?

Let’s dig deeper into the quantitative side of the Altadena post-fire investor activity—what is the investor model, and what are they planning to do with these lots?

From what I see in the field, there are essentially three broad investor strategies in play:

A. Build and sell (flip model)

In many of the cases above (Ocean Dev, NP Altadena I, Black Lion), the intent appears to be: purchase fire-scar lot cheap, build a new single-family home up to current market standards, then sell it at market price. Margins can be healthy if the land basis is low, labor/permit costs moderate, and sales demand strong. Because Altadena is near Los Angeles employment centers, has scenic views, and limited supply, the upside is attractive.

B. Build and hold for rental income

Some investors are holding new homes as rental properties. Given the scarcity of large lots and new product in the hills, class-A rental homes generate strong income and can offer inflation-hedged returns. One unit or several units might be dedicated to long-term lease rather than immediate flip.

C. Buy and hold undeveloped/land bank

A smaller number appear to simply buy the fire-scar lots, maybe clear them, secure entitlement or grading, and then hold for appreciation. The investor bet here is that as rebuilds progress, scarcity in Altadena will press values upward. This is more of a “value store” strategy than immediate development.

From the publicly reported acquisitions, the majority seem to lean toward model A (build & sell). For example, Black Lion explicitly positions its Altadena purchases as “new single-family homes for families wanting to live in Altadena” rather than pure passive hold. But the presence of private equity-linked LLCs and investment firms suggests that models B and C play a role too.

What does this mean for the original

community and for the “character” of Altadena?

The heart of this matter is not just about numbers—it’s about

neighborhood identity, community equity, and what happens when investor capital

floods an area recovering from disaster.

As someone who grew up around here and now serves as a commercial real

estate broker and investment advisor, I see a tension:

- On one hand, the influx of

capital means damaged lots are being purchased, cleared, rebuilt—so one

could argue there is recovery activity.

- On the other hand, the Altadena

post-fire investor activity is reshaping who lives here, what housing

looks like, and whether those displaced original homeowners get a fair

shot at rebuilding.

Community impacts:

- Housing affordability: Many of the new homes being

built sell or rent at prices far above what the longstanding Altadena

community could afford. If a family who owned a home for generations now

sees the investor-built houses listed for $2.5 M or rented at $4,000+ per

month, they cannot participate.

- Cultural identity: Altadena has always had a

unique “hilltown” character—older craftsman homes, generational families,

scenic views and community ties. When outsiders come in, purchase our

lots, build modern homes, and flip them or lease them, the character

shifts from local-owner occupied to investor-owned.

- Loss of rebuild equity: For owners with low mortgages

or paid-off homes, the decision to sell rather than rebuild means they

lose the “house as generational asset” model. They may be renting

elsewhere, while their former land becomes an income vehicle for a

corporate entity.

When we talk about Altadena post-fire investor activity, it isn’t

neutral: it is altering the ownership structure and thereby the social

structure of the foothill community.

Rebuilding vs. selling: what the

numbers suggest

One of the key questions: are more lots being sold to investors than

being rebuilt by original owners? The evidence says yes.

- As of summer 2025: ~70% of

severely damaged homes in Altadena had no permits filed or

observable rebuild activity.

- Meanwhile, investor acquisitions

are now over half of all lots sold in the fire zone.

- In short: in many cases the

“owner rebuild” path is not being taken; instead lots are being sold

(often under distress) to investors.

Why does that matter? Because build-costs plus financing plus

permit/matching delays often mean owners can’t feasibly rebuild when measured

against market value. Instead of waiting, they opt to sell—sometimes quicker,

sometimes with less upside but much less risk.

In effect, many owners are “liquidating” what was once their home-asset

and allowing investor capital to purchase the land. It’s a transformation of

land-asset from homeowner equity to investor undertaking.

Can the original owners afford to live

in the newly built homes?

We must ask the question: if the new homes are built and ready, could the

original homeowners—or their families—actually move back in (either as buyers

or renters)? The practical answer, in many cases, is no.

For owners trying to buy

Because many investor deals include modern, upgraded homes built to new code

and market standards, they list at prices that reflect that value (often

$1.5-3M+ in Altadena, depending on size/view/lot). The original homeowner who

sold a lot for, say, $500-600k may not be able to re-enter at the new price

point. The gap is too large.

For renting

The rental story is similar. With rental rates for newer homes in desirable

Altadena locations now in the $3,000-$5,000+ per month range, many longtime

residents are priced out. If their income was modest (say $60k-$120k/year)

before, the new rental burden becomes unaffordable.

Thus, from a displacement perspective, even though the land is being reused and

new homes are going up, the people who were there before are largely not the

ones inhabiting them.

What should investors and original owners both know?

From the vantage of a commercial real?estate investment advisor (and as a

CCIM with decades of market involvement), there are a number of cautionary

points that both sides—investors and original homeowners—should consider.

For homeowners considering rebuilding

- Understand the full rebuild cost

(including grading, erosion control, fire-safe requirements, higher permit

fees, potential site remediation).

- Factor in elevated borrowing

costs: high interest rates mean higher debt service, narrower margins.

- Be realistic about timeline:

delays = carrying costs, gap risk, living elsewhere while rebuild occurs.

- If you’re selling the lot, weigh

the long-term value of keeping the home (especially for generational

equity) vs. immediate sale.

- If you intend to return as a

renter or buyer in the rebuilt market, do the math and see if it’s

feasible.

For investors looking at the Altadena post-fire market

- Premiums are being paid now for

lots; know your basis. Land is expensive.

- Permitting & rebuild risks

remain real (fire-code upgrades, site constraints, neighborhood

opposition, slope/erosion).

- Exit strategy matters: are you

building and flipping quickly, building and holding for rent, or buying

and holding for speculation? Each has different risk/reward profiles.

- Be mindful of “community

optics”—when investor ownership dominates, neighborhood character and

long-term appreciation may shift differently than purely local-owner

areas.

My bottom line: market realities and

community loss

From my vantage point, the trajectory is clear: far more outside

investors are purchasing lots in the Altadena fire-scar zones than are being

rebuilt by original owners. The reasons are structural: high borrowing costs,

permitting delays, insurance gaps, and generational inequities in capital

access.

I understand these market pressures—as a broker I see the trades happen daily.

At the same time, I feel a sense of loss for the Altadena I knew growing up: a

community of local-owner families, long-term relationships, and smaller

craftsman homes on shady foothill streets. The wave of investor purchases and

new homes built for market premium are reshaping that identity.

In short, the Altadena post-fire investor activity is indeed real,

substantial, and reshaping the market—and the community.

What’s next for Altadena?

As we look ahead, several possible trajectories emerge:

- If the rebuilding pace catches

up—original owners rebuild, local owner-occupancy returns—the community

may retain more of its character and affordability.

- If investor dominance persists,

Altadena could become increasingly “professional developer/resident”

oriented: high-end homes, higher rents, fewer generational owners.

- Policy interventions (such as

right-of-first-refusal for original homeowners, tax incentives, rebuild

grants) could shift the mix—but so far rollout has been slow.

For prospective buyers (owner-occupant or investor) this means diligence

is critical: understand the land basis, zoning/permits, rebuild timeline, and

neighborhood dynamics. For existing homeowners deciding between rebuilding and

selling, the calculus has never been more complex.

Conclusion

Rebuilding after a wildfire is a formidable undertaking—but so is

investing in post-fire land. Both rebuilding and investing carry risk, require

deep local market knowledge and access to capital, and face the realities of

timing, regulatory hurdles and community dynamics.

If you are a homeowner in Altadena considering your next step—whether to

rebuild your legacy home, sell your lot, or rent back in—carefully weigh the

costs, timeline, and future housing market realities.

If you are an investor looking at the region, whether you intend to build and

flip, build and hold, or land-bank, ensure you clearly understand your exit

strategy, the full scope of entitlement/risk, and the evolving character of the

neighborhood.

I’m here to help. Advice is free—if you’re navigating a decision in

Altadena’s post-fire land market (or any commercial real-estate investment in

the greater Southern California area), I’d be glad to guide you through the

process. Contact me and let’s talk through your options.

Brion Costa, CCIM

Century 21, Commercial

626-695-7385

DRE#: 00939864