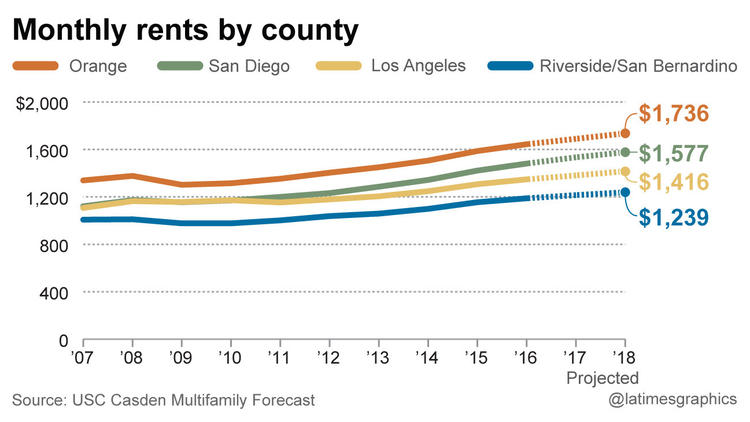

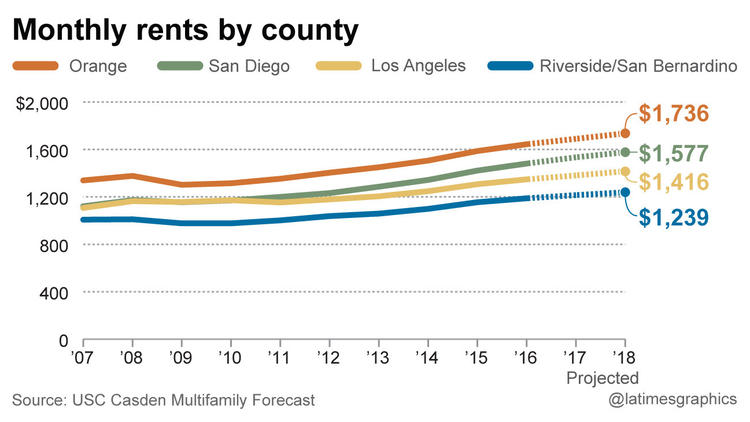

Real Estate News - "Sky-high apartment rents in Southern California are expected to climb further in coming years, as construction fails to keep up with population and job growth."

Real Estate News:

The result is that construction has not kept up with demand. When that happens ... prices go up, and that's what we have today with the cost of rentals in Southern California. And, we have no relief in sight for the near future.

There is, however, a hint of possible good news here, in that the economic experts who compile the USC Casden Multifamily Forecast believe that we may be seeing the "beginning of the end" of this trend. They're not predicting a "rental turnaround" immediately, but are saying that there are factors in play that could foreshadow the end of this "bull market" in Southern California apartment rents.

Here's a comprehensive article by Andrew Khouri from the L.A. Times. This article is based on the Casden report, but only mentions the fact that there is no relief in site immediately. It does not delve into the more complicated subject of just when this trend of really high cost for apartments in Southern California might come to an end ... or at least slow down. The full report does address this, and it's available for you to download at the bottom of this page.

If you would like to read this complete report, You can download the FULL REPORT here: https://lusk.usc.edu/casden/multifamily/report

Real Estate News

Real Estate News:

No Relief In Sight For Southern California Apartment Rents

San Gabriel Valley Apartments Are No Exception

The USC Casden Multifamily Report is out, and it's not good news for renters just yet. The report finds no relief in sight as far as Southern California apartment rents are concerned ... in the near future. Of course, San Gabriel Valley apartments are not miraculously exempt from this trend as the underlying cause is simple: supply and demand. And the rules of Supply and Demand are in effect in all of Southern California. Anyone who has tried to rent an apartment anywhere in Southern California will be aware that rents are high just about anywhere. The fact is that over the last decade there were a lot of folks who were homeowners who are not anymore. They lost their homes in foreclosure and began renting their home or became apartment dwellers. Financial conditions over the last few years, combined with the new, high prices to purchase a home have also contributed to the number of renters seeking dwellings for rent.The result is that construction has not kept up with demand. When that happens ... prices go up, and that's what we have today with the cost of rentals in Southern California. And, we have no relief in sight for the near future.

There is, however, a hint of possible good news here, in that the economic experts who compile the USC Casden Multifamily Forecast believe that we may be seeing the "beginning of the end" of this trend. They're not predicting a "rental turnaround" immediately, but are saying that there are factors in play that could foreshadow the end of this "bull market" in Southern California apartment rents.

Here's a comprehensive article by Andrew Khouri from the L.A. Times. This article is based on the Casden report, but only mentions the fact that there is no relief in site immediately. It does not delve into the more complicated subject of just when this trend of really high cost for apartments in Southern California might come to an end ... or at least slow down. The full report does address this, and it's available for you to download at the bottom of this page.

Southern California Apartment Rents Are Expected To Continue Rising Through 2018 | L.A. Times

Los Angeles Times"Sky-high apartment rents in Southern California are expected to climb further in coming years, as construction fails to keep up with population and job growth, according to a forecast released Tuesday. The average rent in Los Angeles County is expected to hit $1,416 a month in 2018, an 8.3% jump from last year, while in Orange County, average rents are likely to rise 9.4% to an average of $1,736, the USC Casden Multifamily Forecast said."Read More Here: http://www.latimes.com/business/realestate/la-fi-casden-forecast-20160412-story.html

The USC Casden Multifamily Report

The USC Casden Multifamily Report is a long standing and well-respected part of the Casden Real Estate Economics Forcast, which is part of the USC Lusk Center. It operates under the Casden Endowment, originally funded by Alan Casden, a major developer of Southern California multifamily housing.If you would like to read this complete report, You can download the FULL REPORT here: https://lusk.usc.edu/casden/multifamily/report

Real Estate News