The multifamily real estate market in Southern California, with its dynamic blend of challenges and opportunities, continues to captivate investors nationwide. As we navigate through 2024, understanding the nuances of this vibrant market is crucial for those looking to maximize their investment returns and to avoid the pitfalls of our current challenges as well. From emerging trends in affordability and supply to strategic investment insights, this article delves into the multifamily real estate investments landscape, offering valuable perspectives for both seasoned and aspiring investors.

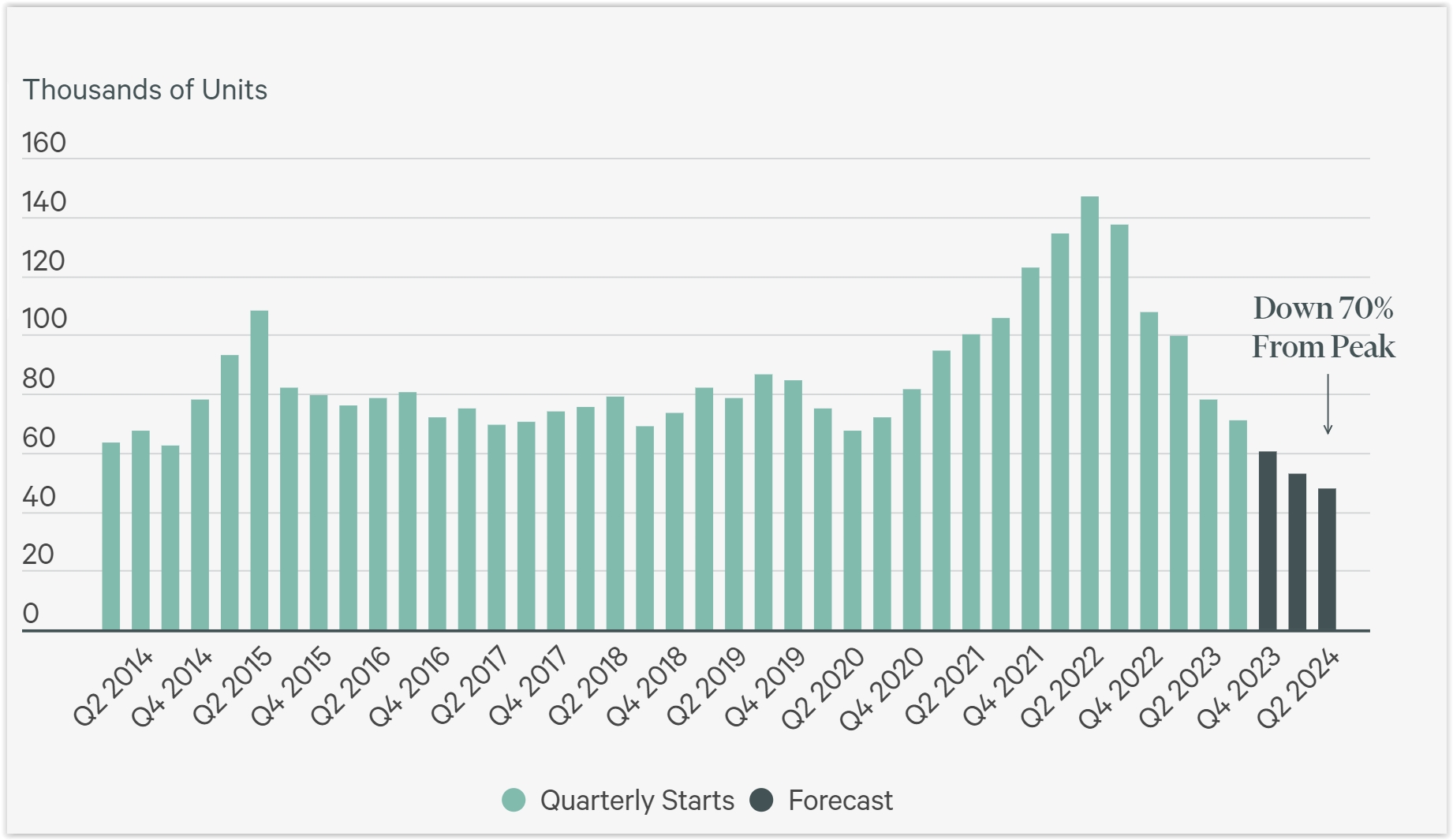

MULTIFAMILY CONSTRUCTION STARTS NATIONWIDE.

We were saturated, and are pulling back.

Supply and Demand Dynamics in Southern California's Multifamily Real Estate Investments Market

The multifamily real estate sector in Southern California is at a pivotal juncture in 2024, shaped by significant demographic shifts and a redefined living landscape post-pandemic. A robust increase in multifamily construction marks the region's response to burgeoning demand, yet this uptick in supply introduces complexities into the investment equation. Notably, certain areas within Southern California are bucking the national trend of oversupply, presenting a nuanced picture of market opportunities. The region's appeal, driven by its economic diversity and population growth, continues to attract a steady influx of residents, thereby sustaining demand for multifamily housing. This dynamic suggests that, despite broader trends, Southern California's multifamily sector could defy expectations, offering strategic investors a fertile ground for yield optimization.

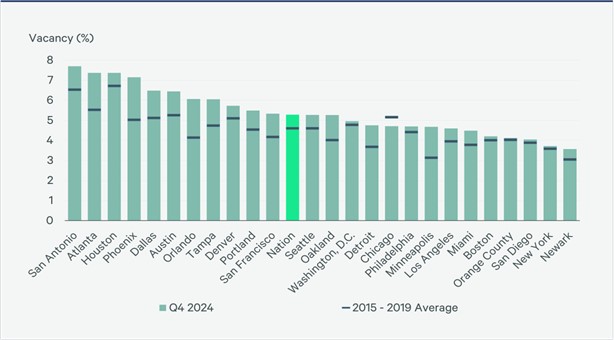

VACANCY RATES AT THE END OF 2023 IN MAJOR CITIES.

Los Angeles is among the lowest vacancy rates in the nation,

but still above our average for 2015-2019

Economic Resilience and Its Impact on Multifamily Real Estate Investments

2024 heralds a testament to the economic resilience that underpins the multifamily sector's robustness, particularly in Southern California. With the economy maintaining momentum — characterized by low unemployment rates and vigorous consumer spending despite high inflation — the multifamily market benefits from a solid foundation of demand. This economic backdrop is crucial for investors to consider, as it not only supports current occupancy levels and rental income stability but also signals potential growth avenues. The resilience of the job market, especially, plays a pivotal role in sustaining demand for multifamily units, making Southern California an attractive locale for long-term investment strategies.

Addressing the Affordability Crisis Through Multifamily Real Estate Investments

The persistent affordability crisis in housing remains a focal point of concern, particularly in densely populated regions like Southern California. The documents reveal a deepening challenge for renters, especially those in lower-income brackets who find themselves increasingly cost-burdened. This scenario, however, also underscores a significant demand undercurrent for multifamily units that cater to a wider economic demographic. Investment opportunities abound in developments that bridge the affordability gap, offering a dual benefit of fulfilling a critical housing need while ensuring steady rental income streams for investors. By focusing on affordability, investors can tap into a resilient market segment poised for growth amidst broader economic fluctuations.

Legislative and Regulatory Landscapes Shaping Investment Strategies

Southern California's multifamily market is intricately influenced by local and state legislative frameworks, with policies such as Measure ULA and statewide housing initiatives playing critical roles. These regulations impact development costs, rental market dynamics, and investment returns, necessitating a strategic approach to multifamily investing. Understanding the implications of these legislative changes is crucial for investors aiming to navigate the complexities of the Southern California market effectively. By aligning investment strategies with regulatory environments, investors can mitigate risks and capitalize on the opportunities presented by policy-driven market shifts.

Navigating Multifamily Real Estate Investments with Expertise

The multifamily real estate landscape in Southern California, while presenting undeniable opportunities, also demands a nuanced understanding of its complex dynamics. Investors, from novices looking to get a foothold in the market or veterans looking for an alternative to the 401K for retirement, stand to benefit from the insights gleaned from a detailed analysis of market trends, economic resilience, affordability challenges, and the legislative landscape. As the market evolves, the guidance of seasoned commercial real estate advisors becomes invaluable. These professionals can provide the strategic foresight needed to navigate the market's complexities, ensuring that investment decisions are both informed and impactful.

In conclusion, multifamily real estate investments in Southern California offer a compelling proposition for those equipped with the right insights and strategies. By understanding the unique dynamics at play, investors can position themselves to capture growth, address critical housing needs, and achieve sustainable returns in this vibrant market.

Brion Costa, CCIM

Century 21, Commercial

626-695-7385

DRE#: 00939864