Comprehensive Analysis of Los Angeles Industrial Commercial Real Estate Trends in 2023-24

In the ever-evolving landscape of industrial commercial real estate in Los Angeles, 2023 stood out as a year of recalibration and strategic shifts. Today we'll take an in-depth look into the trends, challenges, and opportunities that have shaped the market over the past year. This analysis not only deciphers the complex dynamics of the present market but also casts a forward-looking gaze into the future of industrial commercial real estate in Los Angeles.

The State of Industrial Real Estate in Los Angeles:

A 2023 Overview

Reflecting on Net Absorption and Lease Rates

The industrial market's heart rate is often measured by its net absorption rates and average asking lease rates. The "absorption rate" is a measure of supply and demand in any given market --- what percentage of available properties are "absorbed" by buyers or lessees and how quickly. In 2023, Los Angeles witnessed a nuanced narrative of recovery and stabilization. The fourth quarter reported a net absorption of -190,961 square feet. Though still negative, this figure marks an improvement, suggesting a gradual absorption of the excess space that burgeoned during the pandemic boom.

Lease rates in Q4 edged higher to $1.75 per square foot. This incremental increase from the $1.74 seen in previous quarters is a testament to the market's resilience. Despite broader economic uncertainties, these rates indicate stable investor confidence and a balanced supply-demand equation in the Los Angeles industrial sector.

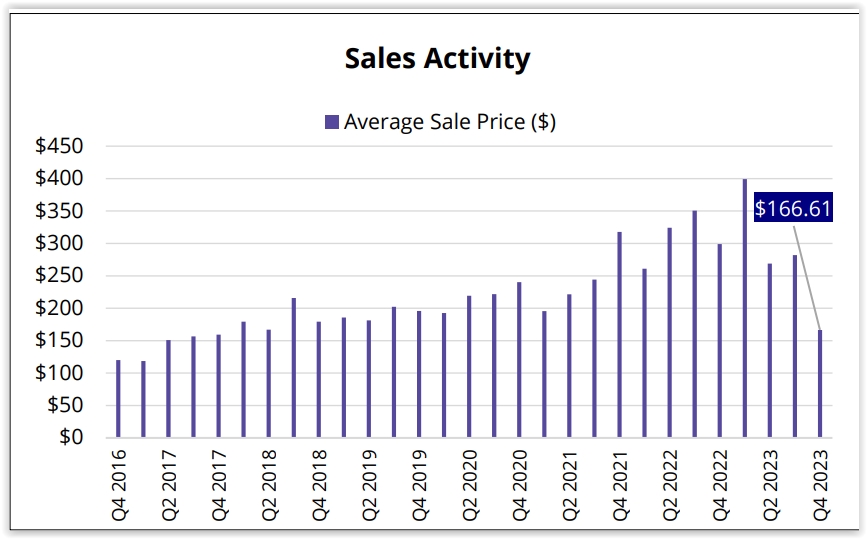

Sales Activity - Average square foot price of sold properties fell in comparison from Q1 through Q4 2003. It showed a 41% decrease in sales price per square foot to $166.61.

Sales Activity: Reading Between the Lines

A closer look at the sales activity reveals a market in transition. With a notable 41% drop in the average sale price per square foot from the previous quarter, the data signals a significant market correction. This downward adjustment in prices reflects a more realistic alignment with current demand levels and broader economic factors influencing the industrial real estate sector.

The Vacancy Conundrum

Vacancy rates, both direct and sublet, offer critical insights into market health. The climb in direct vacancy rates in 2023 underscores a strategic shedding of space by businesses, adjusting to a post-pandemic reality. This shift towards optimizing space usage is a clear response to changing market dynamics and the need for efficiency in uncertain times.

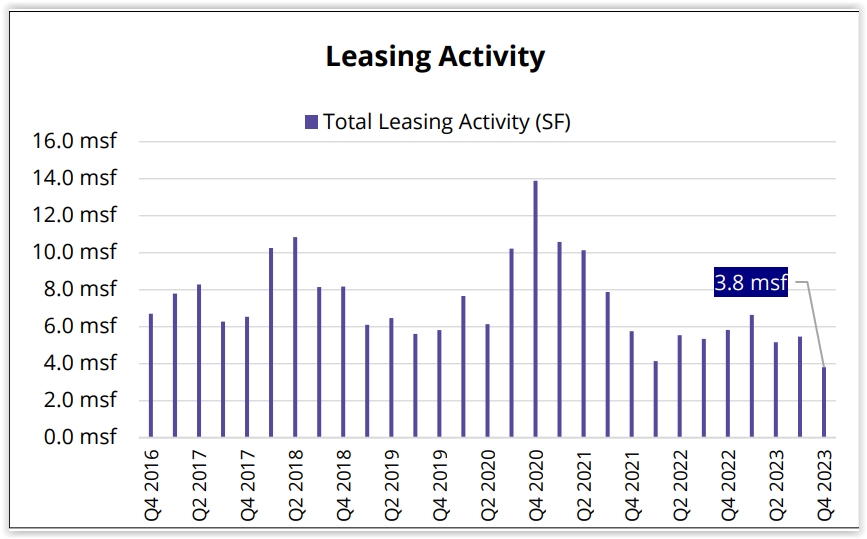

Leasing Activity - As expressed in square feet, leasing activity in Q4 of 2023 slowed by 1.6 million square feet from the previous quarter to 3.8 million square feet leased.

Diving Deeper: Factors Influencing the 2023 Market

The Port Volume Effect

Los Angeles's position as a pivotal logistics and freight hub means that port volumes have a direct impact on the industrial real estate market. The decline in port volumes throughout 2023 has been a key driver of the changes seen in industrial space demand. This trend is intricately linked to global economic shifts, trade policies, and consumer behavior changes, making it a critical factor for investors to monitor.

External Economic Indicators: The Bigger Picture

Beyond the immediate market metrics, external economic indicators play a crucial role in shaping the industrial real estate landscape. Factors such as inflation rates, interest rates, and international trade tensions can significantly affect investment strategies and market outcomes. In 2023, these broader economic signals provided both challenges and opportunities for the savvy investor. We need to pay close attention to them moving through 2024.

Forward-Looking Strategies:

Navigating 2024 and Beyond

Predicting Market Movements

With the insights gleaned from 2023, investors are better equipped to anticipate future trends in the Los Angeles industrial real estate market. Key indicators to watch include continued shifts in port volumes, occupancy rates, and broader economic trends. Staying informed and adaptable will be crucial for navigating the uncertainties of the market.

Investment Strategies for the Adaptive Investor

In a market characterized by both volatility and opportunity, adopting flexible and informed investment strategies is paramount. Diversifying portfolios, conducting thorough due diligence, and staying abreast of both local and global market trends will be essential for achieving success in the evolving Los Angeles industrial real estate landscape.

The Road Ahead for Los Angeles Industrial Real Estate

The industrial commercial real estate market in Los Angeles has undergone significant transformation in 2023. For investors, understanding these changes and their implications is key to navigating the market's complexities in 2024. As we look ahead, the lessons learned from last year's market dynamics will undoubtedly shape future strategies. The path forward requires vigilance, adaptability, and a deep understanding of the myriad factors that influence the industrial real estate sector.

For those looking to explore the opportunities within Los Angeles's industrial commercial real estate market, the value of expert guidance cannot be overstated. Seeking advice from seasoned professionals can provide the nuanced insights and strategic perspectives necessary to navigate the market's ebbs and flows successfully.

Brion Costa, CCIM

Century 21, Commercial

626-695-7385

DRE#: 00939864